Maximize Your Trading with Pocket Option RSI: A Comprehensive Guide

In the dynamic world of binary options trading, having the right tools and strategies is crucial to success. One such powerful tool is the Pocket Option RSI, a popular indicator that helps traders make informed decisions by analyzing market trends and price movements.

Understanding RSI: A Quick Overview

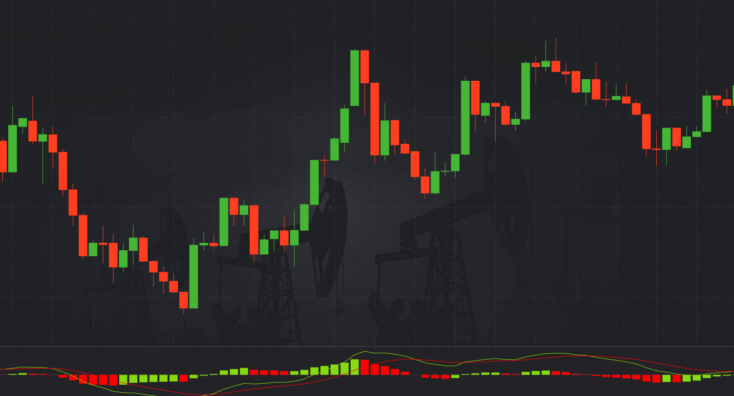

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Developed by J. Welles Wilder, RSI ranges from 0 to 100 and is typically used to identify overbought or oversold conditions in the market. In the context of Pocket Option, this indicator serves as a critical component of trading strategies.

Why Use Pocket Option RSI?

Integrating RSI in your trading approach on Pocket Option can significantly enhance your ability to predict market movements. Here are some of the benefits:

- Identifying Trends: RSI helps identify the direction of the market by displaying whether conditions are bullish or bearish.

- Overbought and Oversold Signals: When RSI moves above 70, it suggests that a market is overbought, while a reading below 30 indicates it is oversold, signaling potential reversal points.

- Enhancing Trade Entry and Exit Points: The RSI can assist in timing your entries and exits in the market, leading to more efficient trades.

Strategies for Trading with Pocket Option RSI

Successfully trading binary options using Pocket Option RSI involves more than just understanding the basics. Here are some strategies to consider:

1. RSI Divergence Strategy

Divergence occurs when the price of an asset is moving in the opposite direction to the RSI. This can be a powerful signal of an impending reversal. Traders can leverage divergence by carefully timing their entries and exits to capitalize on market reversals.

2. Support and Resistance Levels

Combining RSI with support and resistance levels can increase the accuracy of trading signals. When RSI approaches an overbought or oversold level near a significant support or resistance zone, the likelihood of a reversal increases.

3. Using Multiple Time Frames

Analyzing RSI across multiple time frames offers a broader perspective of market conditions. Traders can confirm signals in shorter time frames with trends in longer time frames, enhancing confidence in their trading decisions.

Common Mistakes to Avoid

While RSI is a valuable tool, traders should be cautious of common pitfalls:

- Ignoring Market Context: Always consider the broader market context and avoid relying solely on RSI readings for making trading decisions.

- Overtrading: It’s easy to overtrade when relying too heavily on RSI signals. Make sure to have a comprehensive trading plan in place.

- Not Considering Other Indicators: RSI should be used in conjunction with other indicators and analysis techniques to build a robust trading strategy.

Final Thoughts

By mastering the use of Pocket Option RSI, traders can significantly improve their chances of success in the binary options market. Understanding how to interpret RSI signals, integrating them with other analytical tools, and being aware of common mistakes can provide traders with a competitive edge.

Remember, successful trading is not just about following signals but also about developing a disciplined and prudent approach to market analysis. Engage actively with the market, stay informed, and continuously refine your strategies to adapt to changing market conditions.